are assisted living expenses tax deductible in canada

There are special rules when claiming the disability amount and attendant care as medical expenses. If you or a loved one is living in.

How Can I Reduce My Taxes In Canada

For example housing fees are not tax deductible unless your loved one resides in an assisted.

. Medical expenses generally make up at least a portion of the monthly service fees and entrance fees at assisted living communities. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. A TurboTax QA meanwhile explains that assisted living expenses are tax.

Generally only the medical component of assisted living costs is deductible and you cannot deduct ordinary living costs like room and board. The IRS considers assisted living to be a medical expense and as such it is eligible for the medical expense deduction. If the community charges an entrance or initiation fee directly related to medical care those charges are deductible.

The Health Insurance Portability and Accountability Act also known as HIPPA directs that qualified long. For some residents they might enjoy a tax deduction of the entire monthly fee while some might only get a deduction for the expenses that some specific personal care. Is Assisted Living Tax Deductible.

The only time when room and board can be deducted is when the senior is chronically ill. For information on claiming. Assisted Living Tax Preparation Resources.

Yes assisted living expenses are tax-deductible. Are Assisted Living Facility Cost and Expenses Tax Deductible. Medical expenses can be a major part of your spending as you get older and the costs that you havent been reimbursed for already can be claimed as expenses on your tax.

Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as other qualified long. To calculate your total medical expense. The everyday living costs such as room and board are not tax-deductible.

Unfortunately not all assisted living costs have the possibility of being deducted however if you are living in a community dedicated to assisted living some. According to the Internal Revenue Service IRS taxpayers are allowed to deduct the cost of assisted. Medical Expenses Related To Assisted Living.

For the tax year 2019 any qualifying medical expenses that make up more than 75 of an individuals adjusted gross income can be deducted. Assisted living expenses may also be deductible if an individual requires supervision due to a cognitive impairment such as Alzheimers or another form of dementia. Special rules when claiming the disability amount.

As long as the resident meets the IRS. Assisted living expenses are tax deductible when patients cant care for themselves. There are certain expenses that are prohibited from being tax deductible.

In order for assisted living. Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as other qualified long-term care.

16 Real Estate Tax Deductions For 2022 2022 Checklist Hurdlr

Are Assisted Living Costs Tax Deductible Ask After55 Com

Medical Expenses Often Overlooked As Tax Deductions Cbc News

Is In Home Care Tax Deductible Comfort Home Care

Are There Tax Deductions For Senior Living Expenses

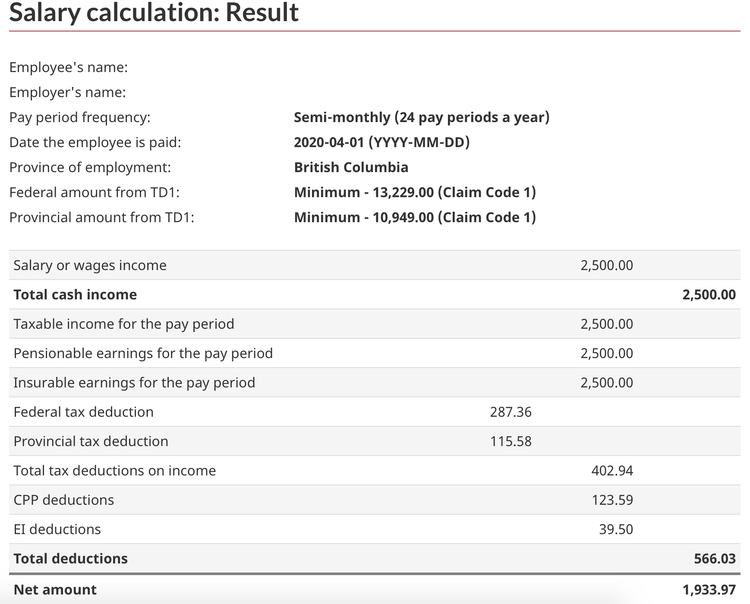

How To Do Payroll In Canada A Step By Step Guide

Are Senior Living Expenses Deductible

Floor Plans Pricing In Athens Oconee County Ga The Landing Senior Living

Breaking Down Work Barriers For People With Disabilities Cardus

Does Medicaid Pay For Assisted Living A Place For Mom

Are Senior Living Expenses Deductible

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

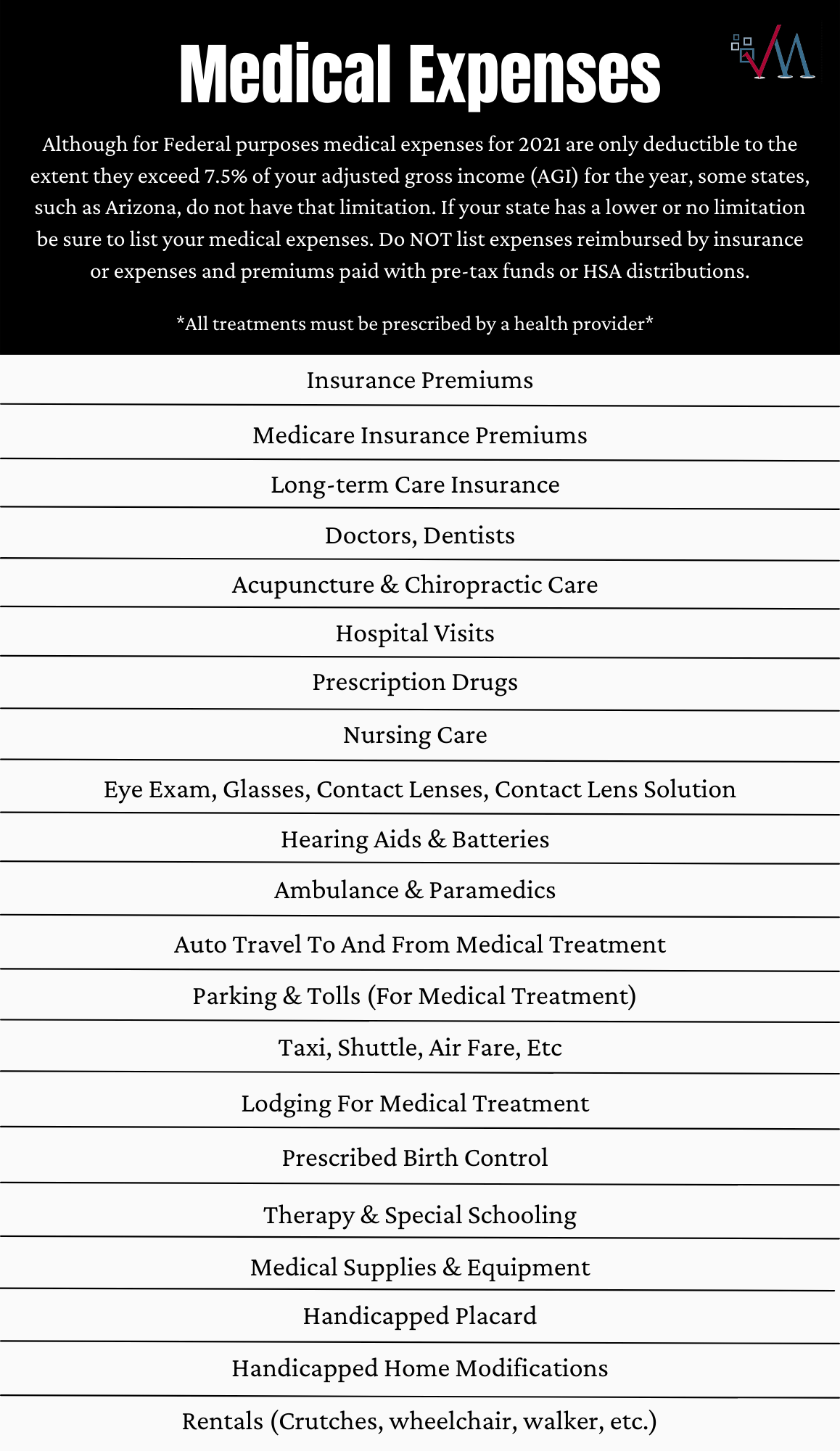

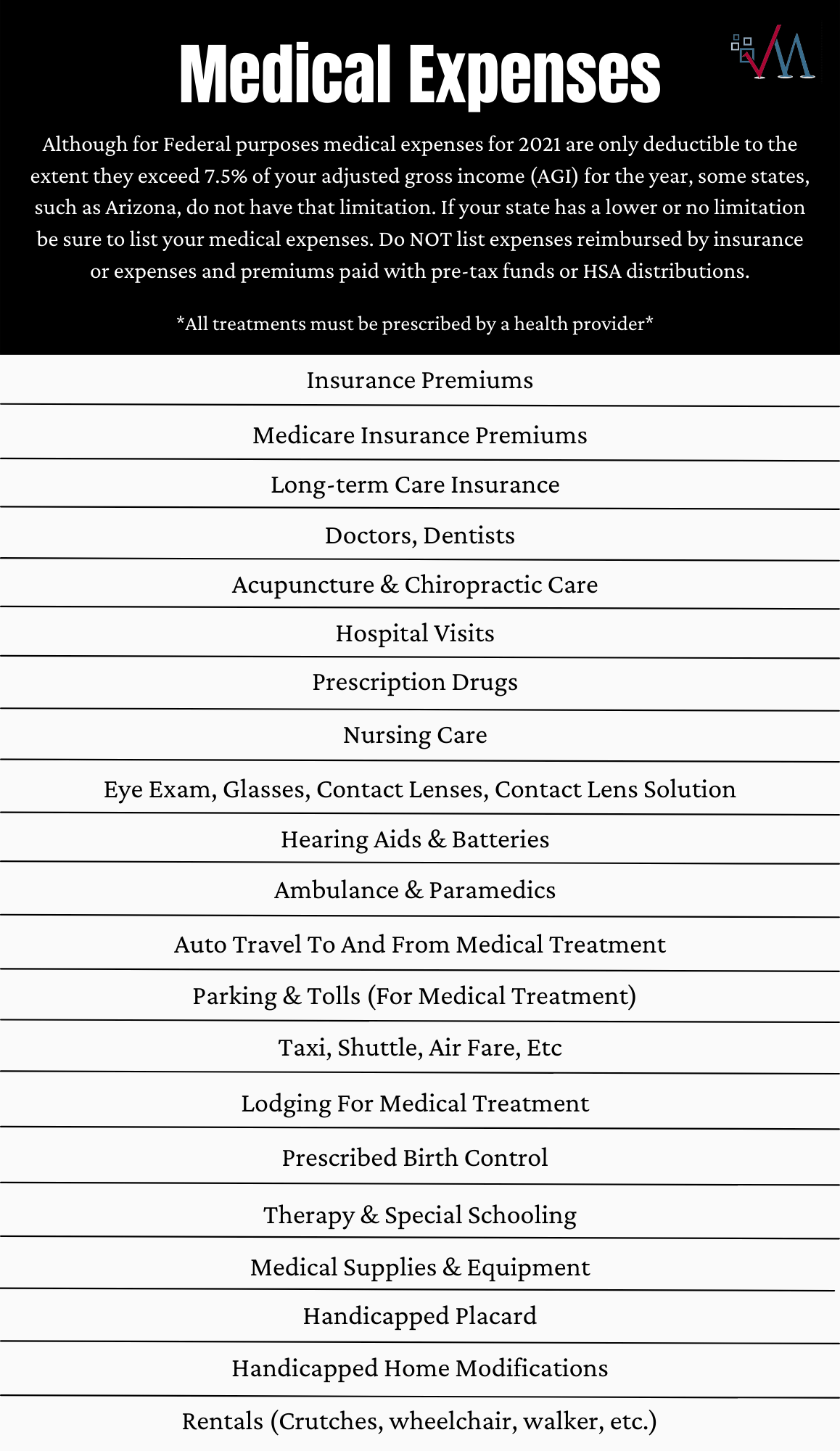

What Are Tax Deductible Medical Expenses The Turbotax Blog

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Blog Tax Related Mendoza Company Inc

Can You Claim A Tax Deduction For Assisted Living The Arbors

10 Tax Deductions For Seniors You Might Not Know About

Multi Level Marketing Company The Tax Considerations Independent Sales Reps Need To Know Hawkins Ash Cpas

:max_bytes(150000):strip_icc()/CreatingaTax-DeductibleCanadianMortgage2_3-32287bf83e94406aba3b1d625e6c295f.png)